(ZeroHedge)—In what some have called a panic/desperation negotiating tactic, Boeing has announced (late on a Friday afternoon) that it will slash its workforce by 10% as the pummeled planemaker struggles with a cash-crunch amid a drawn-out strike and ongoing quality control (to put it nicely) issues.

In a memo to employees, CEO Kelly Ortberg noted that the reductions will include executives, managers and employees, warning that:

“Our business is in a difficult position, and it is hard to overstate the challenges we face together.”

Boeing ended 2023 with 171,000 employees.

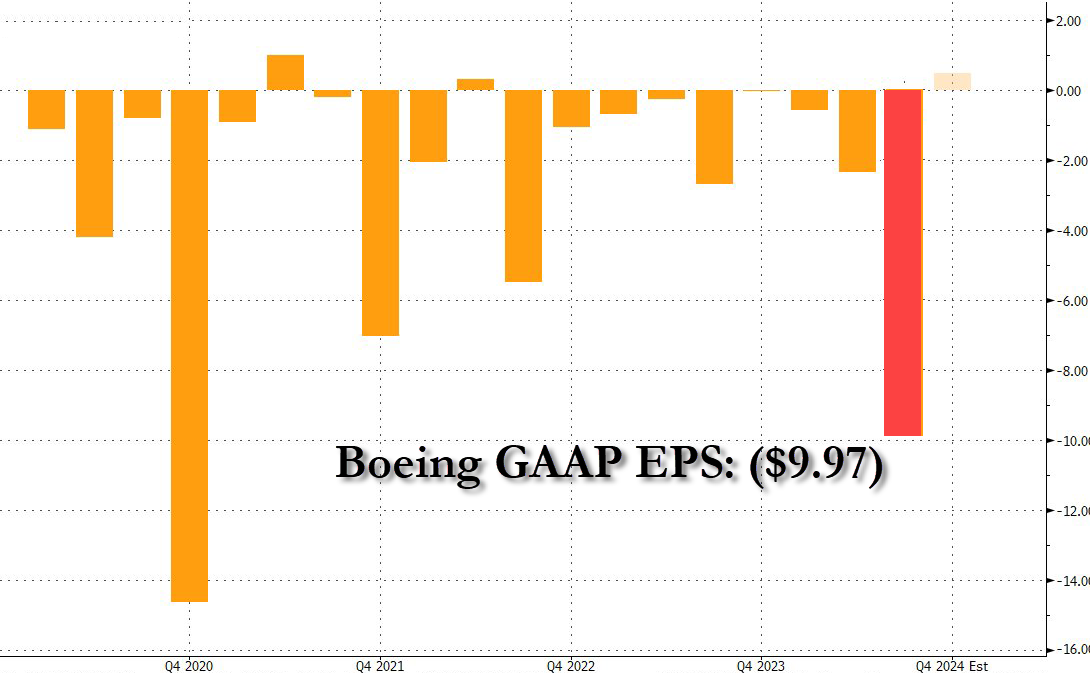

The company said it expects to report third quarter revenue of $17.8 billion, and a loss per share of $9.97, according to preliminary figures.

The company unveiled the measures and the earnings figures as it seeks to get its negotiations with labor unions back on track.

Boeing has made two offers for higher wages, both of which were turned down by workers.

About 33,000 employees at its main Seattle-area facilities have been on strike for a month now, devastating production and draining Boeing’s reserves.

The latest talks collapsed earlier this week, with no clear path when and how they might resume.

Boeing shares tumbled after hours, erasing the day’s gains…

Ortberg also said the company has notified customers that the first deliveries of the 777X are now expected in 2026, citing the ongoing work stoppage and flight test pause.

Read the full press release below:

“While our business is facing near-term challenges, we are making important strategic decisions for our future and have a clear view on the work we must do to restore our company,” said Kelly Ortberg, Boeing president and chief executive officer.

“These decisive actions, along with key structural changes to our business, are necessary to remain competitive over the long term. We are also focusing on areas that are critical to our future and will ensure we have the balance sheet necessary to invest, support our people and deliver for our customers.”

Commercial Airplanes expects to recognize pre-tax earnings charges of $3.0 billion on the 777X and 767 programs. The company now anticipates first delivery of the 777-9 in 2026 and the 777-8 freighter in 2028, resulting in a pre-tax earnings charge of $2.6 billion. This schedule and resulting financial impact are based on an updated assessment of the certification timelines to address the delays in flight testing of the 777-9, as well as anticipated delays associated with the IAM work stoppage. Commercial Airplanes also plans to conclude production of the 767 freighter and recognize a $0.4 billion pre-tax charge on the program, which also reflects impacts from the IAM work stoppage. Beginning in 2027, the company will solely produce 767-2C aircraft in support of the KC-46A Tanker program. Commercial Airplanes expects to report third quarter revenue of $7.4 billion and operating margin of (54.0) percent.

Defense, Space & Security expects to recognize pre-tax earnings charges of $2.0 billion on the T-7A, KC-46A, Commercial Crew, and MQ-25 programs. The T-7A program pre-tax charge of $0.9 billion was driven by higher estimated costs on production contracts in 2026 and beyond. The KC-46A program pre-tax charge of $0.7 billion reflects the decision to conclude production on the 767 freighter and impacts of the IAM work stoppage. Results also include unfavorable performance on other programs. Defense, Space & Security expects to report third quarter revenue $5.5 billion and operating margin of (43.1) percent.

Finally, a quick thought for all the other corporations out there…

*BOEING PRELIM 3Q REV. $17.8B, EST. $18.58B

*BOEING EXPECTS TO RECOGNIZE ABOUT $5 BILLION EARNINGS CHARGESgoing woke was not such a great idea https://t.co/rF33WdGSgz pic.twitter.com/cwmw6izvsH

— zerohedge (@zerohedge) October 11, 2024

Live by the capitalist sword, DEI by the socialist sword…

Don’t just survive — THRIVE! Prepper All-Naturals has freeze-dried steaks for long-term storage. Don’t wait for food shortages to get worse. Stock up today. Use promo code “jdr” at checkout for 35% off!